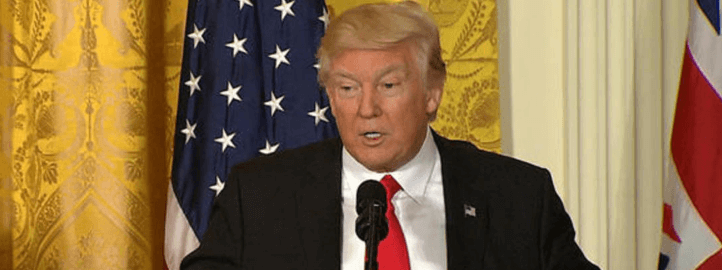

Trump 'Confidence Economy'

The failed attempt by Republicans to push their health-care plan through Congress has put Trump’s ambitious economic plans in serious doubt, particularly as despite having a majority in both chambers Trump’s first attempt at making major changes failed.

Prior to this failure investors were being reasonably patient, displaying optimism about the new Presidential administration. In fact optimism raised the S&P 500 up a full 10 percent after the election but it has fallen recently, as much as 2.4 percent since topping out in March. The concern over Trump’s inability to do as he promised is likely to further negatively affect the market if he continues to fail to move forward with his planned changes. Trump’s failure to get the American Health Care Act passed raises red flags for investors, with optimism waning.

According to an opinion piece recently written by Mohamed El-Erian, Allianz chief economic advisor, the United States is living in a ‘confidence economy’ that is based primarily on sentiment. He went on to write that he believes that if Trump’s administration cannot work in cooperation with Congress to put the President’s plans into solid action confidence in President Trump is likely to have negative consequences, and cause serious financial volatility. As stock market volatility is currently at its lowest since 1972 this lack of confidence comes at a bad time.

If the President faces the same problems with his tax reforms as he did with his healthcare reforms the stock market is likely to face increasing pressure. In Trump’s favor, however, is his encouragement of U.S. companies to invest in the United States. That being said Trump’s lack of political background is still worrying and investors are concerned about how the next few months of his Presidency will affect the stock market in general.